Renters Insurance in and around Huntington Beach

Your renters insurance search is over, Huntington Beach

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Ca, Az, Nv

There’s No Place Like Home

Home is home even if you are leasing it. And whether it's a condo or a townhome, protection for your personal belongings is a good idea, especially if you own items that would be difficult to fix or replace.

Your renters insurance search is over, Huntington Beach

Rent wisely with insurance from State Farm

Why Renters In Huntington Beach Choose State Farm

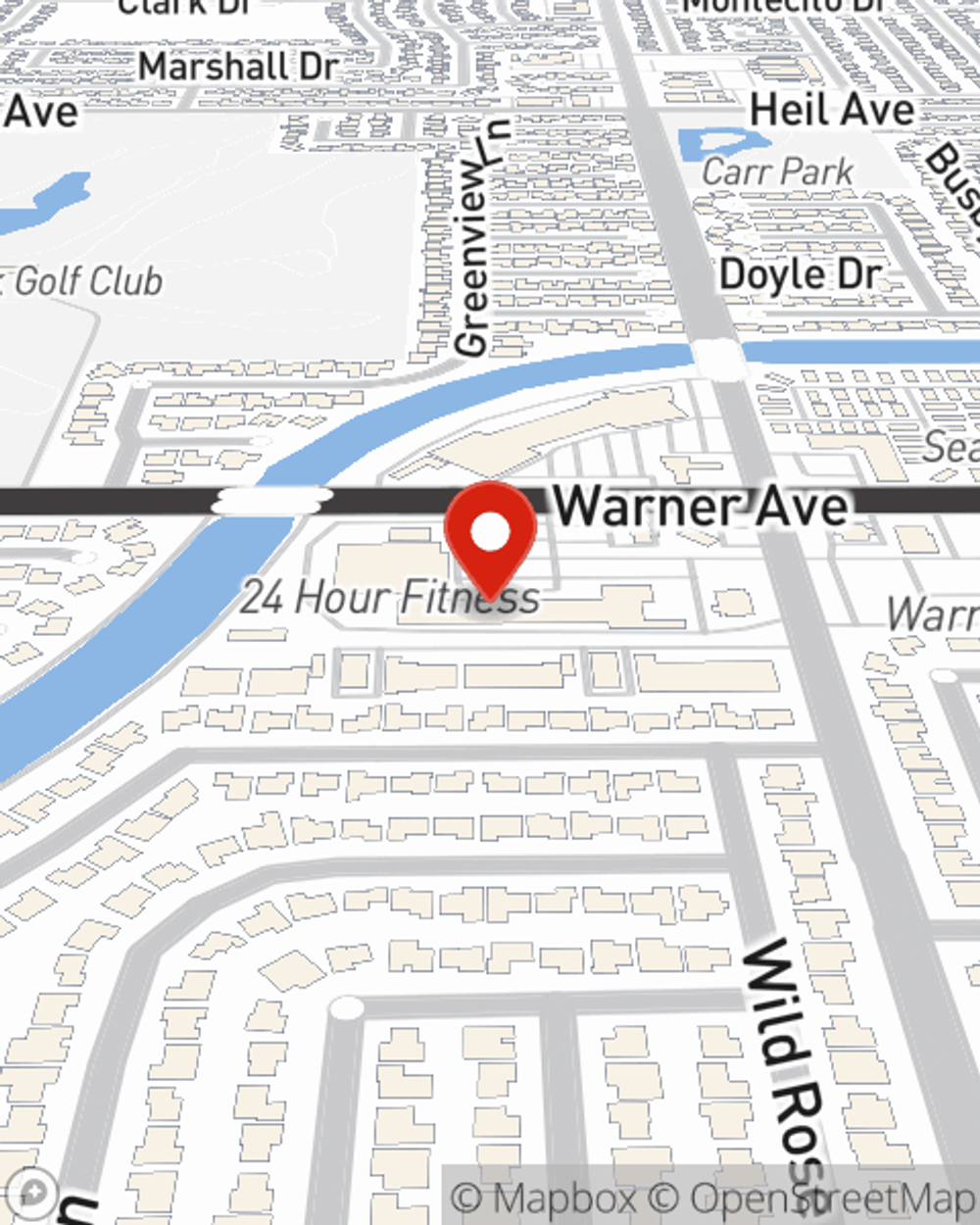

It's likely that your landlord's insurance only covers the structure of the space or condo you're renting. So, if you want to protect your valuables - such as a cooking set, a desk or a coffee maker - renters insurance is what you're looking for. State Farm agent Ric Weissinger wants to help you understand your coverage options and insure your precious valuables.

A good next step when renting a house in Huntington Beach, CA is to make sure that you're properly protected. That's why you should consider renters coverage options from State Farm! Call or go online today and learn more about how State Farm agent Ric Weissinger can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Ric at (714) 377-1111 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Ric Weissinger

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.